disclaimer: all the blog entries here are solely for your information only and does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You may wish to seek advice from a financial adviser rep before making a commitment to purchase any insurance product. In the event that you choose not to seek advice from a financial adviser rep, you should consider whether the product in question is suitable for you.

Monday, April 30, 2012

Sunday, April 29, 2012

Saturday, April 28, 2012

Wednesday, April 25, 2012

Monday, April 23, 2012

Sunday, April 22, 2012

Saturday, April 21, 2012

Friday, April 20, 2012

Thursday, April 19, 2012

Wednesday, April 18, 2012

launch of zurich life insurance singapore

today, david choo, the md of promiseland independent pte ltd and myself attended the grand launch of zurich life insurance singapore at the marina mandarin hotel.

we have heard that zurich international life has applied for a full licence many months ago and today, the subsidiary of zurich insurance group, which is zurich life insurance singapore has been granted a full licence by the monetary authority of singapore to sell products to a wider market where previously, the company could only target a defined market with a restricted licence.

zurich international life has been operating locally since 2006 and has been limited to the mass affluent and affluent market which represents some 5% of the total market.

mr graham morrall, chief executive of zurich life insurance singapore said that with the full licence, the company is reaffirming its full commitment to the singapore market and will enable it to tap a bigger segment of the market although the company does not intend to compete in the mass market.

my comments:

zurich life insurance already has tie-ups with both anz and citibank to tap the bancassurance channel and will explore more bank partners to distribute their products.

it also has an existing agency force of approximately 50 tied agents and aims to double this number by the end of 2012.

across the causeway, zurich financial services has already acquired compostie insurer, malaysian assurance alliance.

we are excited to be a partner of zurich life insurance singapore and what this means is that consumers here will benefit from having another insurer to add to the wide range of insurance products already available from existing players in our tiny red dot nation.

Tuesday, April 17, 2012

Monday, April 16, 2012

Sunday, April 15, 2012

Saturday, April 14, 2012

Friday, April 13, 2012

Thursday, April 12, 2012

government revises healthcare subsidies for PRs

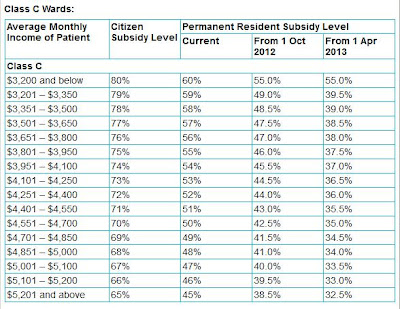

the ministry of health has announced that the healthcare subsidies for prs will be revised downwards for in-patient services (class B2 and class C wards), day surgery and specialist outpatient clinics in government restructured hospitals as well as intermediate and long term care services.

for the intermediate and long term care sector, the adjustments will be implemented in the third quarter of 2012, while the changes in the government restrutured hospitals will see the implementation in 2 phases; in october 2012 and april 2013 to mitigate the effect of these adjustments on prs.

please refer to the coming changes as reflected in the tables as shown.

my comments:

for singapore citizens clamouring for more recognition of the differentiation from prs, this is one of our government's response to putting singaporeans first.

i suppose it is also inevitable given that medical or healthcare costs tend to rise the fastest and i believe insurers offering integrated shield products will have to go back to their drawing board to re-look at the current pricing vis-a-vis the coming implementation of lower subsidies for prs.

and i wouldn't be surprised that the current prices will not stay status-quo once the implementation kicks-in especially with the most cuts on subsidies affecting those who are in the higher or highest income brackets.

Wednesday, April 11, 2012

Tuesday, April 10, 2012

Monday, April 9, 2012

Sunday, April 8, 2012

Saturday, April 7, 2012

Friday, April 6, 2012

thank God, it's friday

Thursday, April 5, 2012

Wednesday, April 4, 2012

Tuesday, April 3, 2012

Monday, April 2, 2012

Sunday, April 1, 2012

aviva - pre-launch of my retirement

officially, aviva has scheduled the launch of their latest product, my retirement on april 04, 2012.

what is aviva my retirement?

this is a limited and regular premium participating endowment product with coverage for death and terminal illness and comes with the following features:

a. limited premium payment of 8 policy years or premium payment for up to 5

years prior to the selected retirement age which is age 50, 55, 60 or 65

years.

b. guaranteed issuance for basic plan and

c. guaranteed retirement income benefit.

the guaranteed retirement income benefit comes with the flexibility of the following options:

a. receive a monthly guaranteed retirement income benefit for 10 years

b. receive the usual full lump sum payment or

c. receive a partial lump sum payment and thereafter, receive a monthly

guaranteed retirement income benefit for 10 years.

what happens if the policyowner/life assured does not need the money when the guaranteed retirement income benefit is due?

there is an option to re-invest this with aviva at a non-guaranteed interest rate of 3.0% p.a. however, the policyowner/life assured can withdraw this partially or even fully anytime inclusive of the interest. there is a minimum withdrawl amount of $1,000.00 (in multiples of $10.00) or balance available, whichever is lower.

the minimum entry age for this product is 17 years and the maximum is 52 years.

my comments:

consumers can expect launch of new insurance products, not to be plain vanilla but more hybrid in design and features. Endowment products of the past were usually pretty basic, like on the maturity of the policy, the insurer will proceed to make a lump sum payment to the policyowner/life assured.

aviva my retirement must never be taken up for protection as the death benefit on death during the accumulation phase is 101% of total premiums paid + accrued reversionary bonus (if any) + terminal bonus (if any) and death benefit during the retirement income period is 101% of total premiums paid + accrued reversionary bonus (if any) + terminal bonus (if any) minus total retirement income paid out (if any) or cash surrender value (less any indebtedness).

furthermore, the plan does not provide for total and permanent disability benefit as well.

Subscribe to:

Posts (Atom)